Our Industry Excellence

Embrace the future of insurance with Quantiphi and Google Cloud

The insurance sector is transforming with generative AI, enhancing experiences, underwriting, claims processing, fraud detection, and business economics.

By 2026, 80% of organizations will use generative AI in production. Quantiphi, a premier Google Cloud partner, can help your insurance organization lead with generative AI-ready data and value-driven solutions for automation and experience. We ensure responsible, ethical, and sustainable implementation, minimizing risks and accelerating time-to-value, empowering you to Be a Next-Gen AI Insurance Leader.

Empower Your Insurance Data for Gen AI-Readiness

As generative AI technology advances, strategic data investments become increasingly critical. With Quantiphi and Google Cloud, we empower enterprises to build a robust, AI-ready data foundation. From migrating legacy systems to Google Cloud to modernizing applications, we enhance operational efficiency and uncover deeper insights. This enables you to deliver superior services, transforming how you serve your customers.

Unify Insurance Data

Break down data silos and gain a holistic view of your customers, operations, and finances.

Craft Your Roadmap

Leverage our Cloud Strategy services to create a tailored plan that aligns with the specific needs of your insurance company.

Power Data-Driven Decisions

Our AI Data Lakehouse solution unifies your data for deeper insights, while Customer 360 creates a comprehensive view of each customer, empowering you to tailor policies, and optimize operations and costs.

Accelerate Innovation with AI

Develop AI-powered applications to personalize customer experiences and streamline insurance workflows. Our secure and scalable Cloud Foundations built on Google Cloud's infrastructure empowers your AI initiatives.

Supercharge Workflows with Intelligent Automation

Intelligent automation has been a game-changer for efficiency and unlocking new possibilities across industries. Now, generative AI is pushing the boundaries even further. Quantiphi and Google Cloud bring generative AI-powered automation to your insurance workflows, reducing costs, enhancing compliance, and speeding up processes. This ensures faster, more reliable insurance services for your customers, increased productivity for your employees and streamlined operations for your organization.

Boost Marketing Analytics

Target the right customers, personalize experiences and optimize marketing campaigns for improved ROI.

Bust Fraud and Anomalies

Equip your team with AI to catch and crush insurance fraud and anomalies in real time.

Turbocharge Underwriting

Automate the mundane and speed up policy issuance by 10%, all while ensuring accuracy.

Accelerate Claims Adjudication

Fast-track auto claims by 30% and boost customer happiness with seamless AI automation.

Master Risk Scoring

Generate laser-accurate risk scores for smarter decisions and pricing.

Minimize Legal Costs

Predict potential litigations early and strategize effectively to reduce legal expenses.

Boost Marketing Analytics

Target the right customers, personalize experiences and optimize marketing campaigns for improved ROI.

Bust Fraud and Anomalies

Equip your team with AI to catch and crush insurance fraud and anomalies in real time.

Turbocharge Underwriting

Automate the mundane and speed up policy issuance by 10%, all while ensuring accuracy.

Accelerate Claims Adjudication

Fast-track auto claims by 30% and boost customer happiness with seamless AI automation.

Master Risk Scoring

Generate laser-accurate risk scores for smarter decisions and pricing.

Minimize Legal Costs

Predict potential litigations early and strategize effectively to reduce legal expenses.

Reimagine Customer Experience with Generative AI

Exceptional customer experience is crucial for brand loyalty in the insurance industry, where every interaction is a chance to exceed expectations. Quantiphi and Google Cloud empower you to create customer-centric solutions that anticipate needs and exceed expectations, leading to heightened satisfaction and loyalty.

Intelligent Virtual Agents

Implement AI-driven virtual agents to answer policy-related queries and offer seamless, personalized customer support.

Personalize Interactions

Deliver highly personalized insurance experiences based on individual customer preferences and behaviors.

Recommend Next Best Actions

Harness AI to analyze customer data and preferences to recommend tailored insurance products, ensuring your customers have the right coverage.

baioniq for Insurance, Quantiphi’s Generative AI Platform

baioniq is Quantiphi’s proprietary enterprise-ready generative AI platform that empowers insurance organizations to supercharge the productivity of their knowledge workers by applying generative AI to downstream tasks.

Accelerate your generative AI journey by accessing, adapting, and fine-tuning foundational LLMs securely in your Google Cloud environment, all while adhering to responsible AI principles.

Explore the future of insurance with generative AI

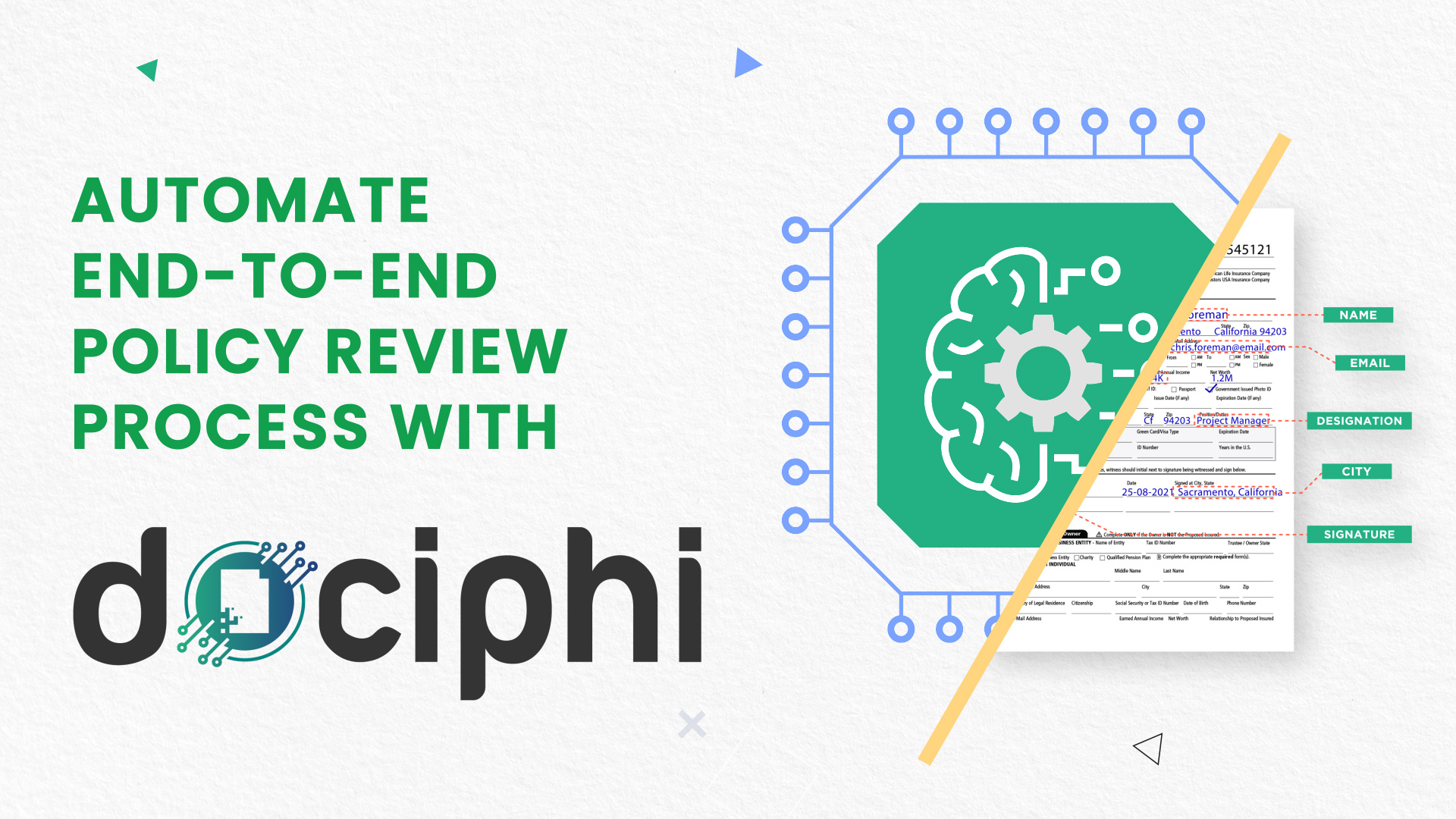

dociphi - Quantiphi’s AI-led Document Processing Platform

dociphi, Quantiphi’s transformative document processing SaaS platform, enables insurers to streamline document processing workflows. Customizable to your company’s needs, dociphi empowers carriers, brokers and third-party administrators to reduce operational costs, time and manual workloads, ensure regulatory compliance and deliver superior customer experiences.

.jpg)

.png)

.png)

.png)

.png)